Affordable Healthcare Solutions, In the United States, where healthcare expenses can be overwhelming, Lively Health Savings Accounts (HSAs) provide a smarter way to save. Designed for individuals, Lively offers a seamless, user-friendly platform that makes managing healthcare expenses straightforward, reliable, and accessible. With Lively HSAs, individuals can set aside pre-tax funds specifically for health-related expenses, turning healthcare savings into a secure financial asset that grows over time.

Lively Health Savings Accounts

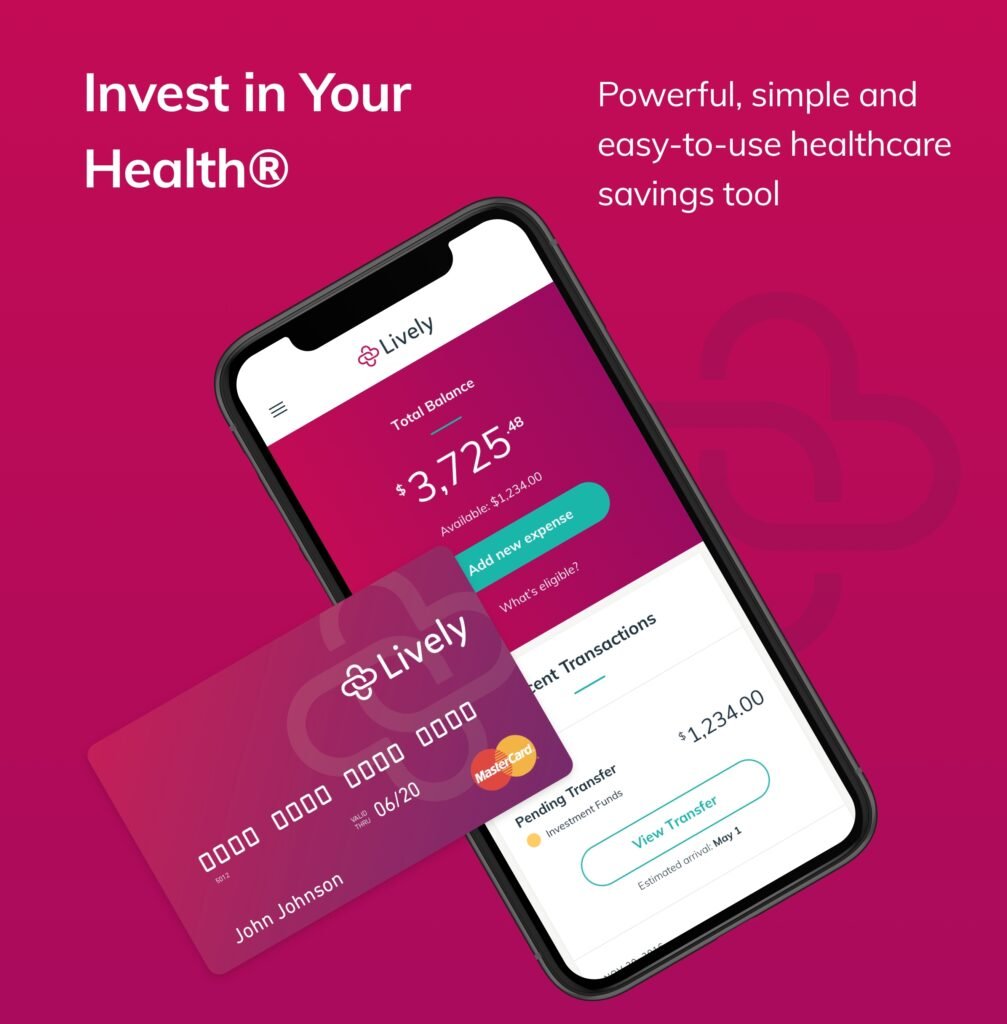

Lively Health Savings Accounts (Sign up for Lively HSA) provide a streamlined, user-friendly platform that makes managing healthcare expenses simpler and more affordable. Designed to complement high deductible health plans (HDHPs), Lively empowers individuals to take control of their healthcare savings with tax advantages, flexible spending options, and tools for planning and tracking expenses.

With an intuitive interface, Lively’s HSAs allow users to access funds for medical costs while enjoying long-term growth potential on unused savings. This flexibility supports both immediate healthcare needs and future financial goals, including retirement savings. Account holders can benefit from pre-tax contributions, tax-free interest, and tax-free withdrawals for qualified medical expenses.

Why Choose Lively?

Lively HSAs are perfect for individuals enrolled in high-deductible health plans (HDHPs) who want to maximize savings while ensuring they have funds ready when medical expenses arise. Here’s how Lively’s innovative approach stands out in the field of financial services for healthcare:

- Intuitive User Experience: Lively understands that managing a Health Savings Account should be simple. Their platform is designed to provide users with a smooth, hassle-free experience, enabling easy access to information and account management features at any time.

- No Hidden Fees: Many HSA providers charge account management fees that can add up over time. Lively believes in transparency, which is why individuals can rely on minimal fees, allowing more of their hard-earned savings to go directly toward health expenses.

- Tax Benefits: Contributions made to an HSA are tax-deductible, and any earnings from interest or investments within the account grow tax-free. Additionally, withdrawals for qualified medical expenses are also tax-free, making HSAs a great long-term saving strategy.

- Flexible Account Management: Whether users need to make contributions, check balances, or manage investments, Lively offers full control from any device. Plus, Lively’s responsive customer support team is available to help users understand their options and get the most from their accounts.

- Effortless Integration with HDHPs: Lively HSAs are designed to complement high-deductible health plans, working in harmony to make out-of-pocket expenses manageable. For individuals or families dealing with regular medical costs, an HSA through Lively provides peace of mind and a reliable way to manage expenses.

Benefits of Lively HSAs for Financial Wellness

- Long-Term Savings: Lively offers investment options that allow users to grow their HSA balances, making it a versatile tool not only for current healthcare needs but also for future financial security.

- Accessible Support: For any questions or assistance, Lively’s expert team is just an email away. For inquiries, users can reach out to Jeremy Meeks at jeremy.meeks@advertisepurple.com to learn more about how Lively can help make healthcare more affordable.

Lively’s commitment to creating a healthier, financially resilient future for Americans makes it an ideal choice for those looking to get the most from their healthcare dollars. Whether you’re an individual navigating the world of high-deductible health plans or a family looking for a trusted solution to cover medical costs, Lively HSAs provide a balanced and dependable way to save.

Get Started with Lively

With a Lively HSA, your savings work for you, making healthcare more manageable and future-focused. Discover the ease and benefits of a Lively HSA and start paving the way to financial and physical well-being.